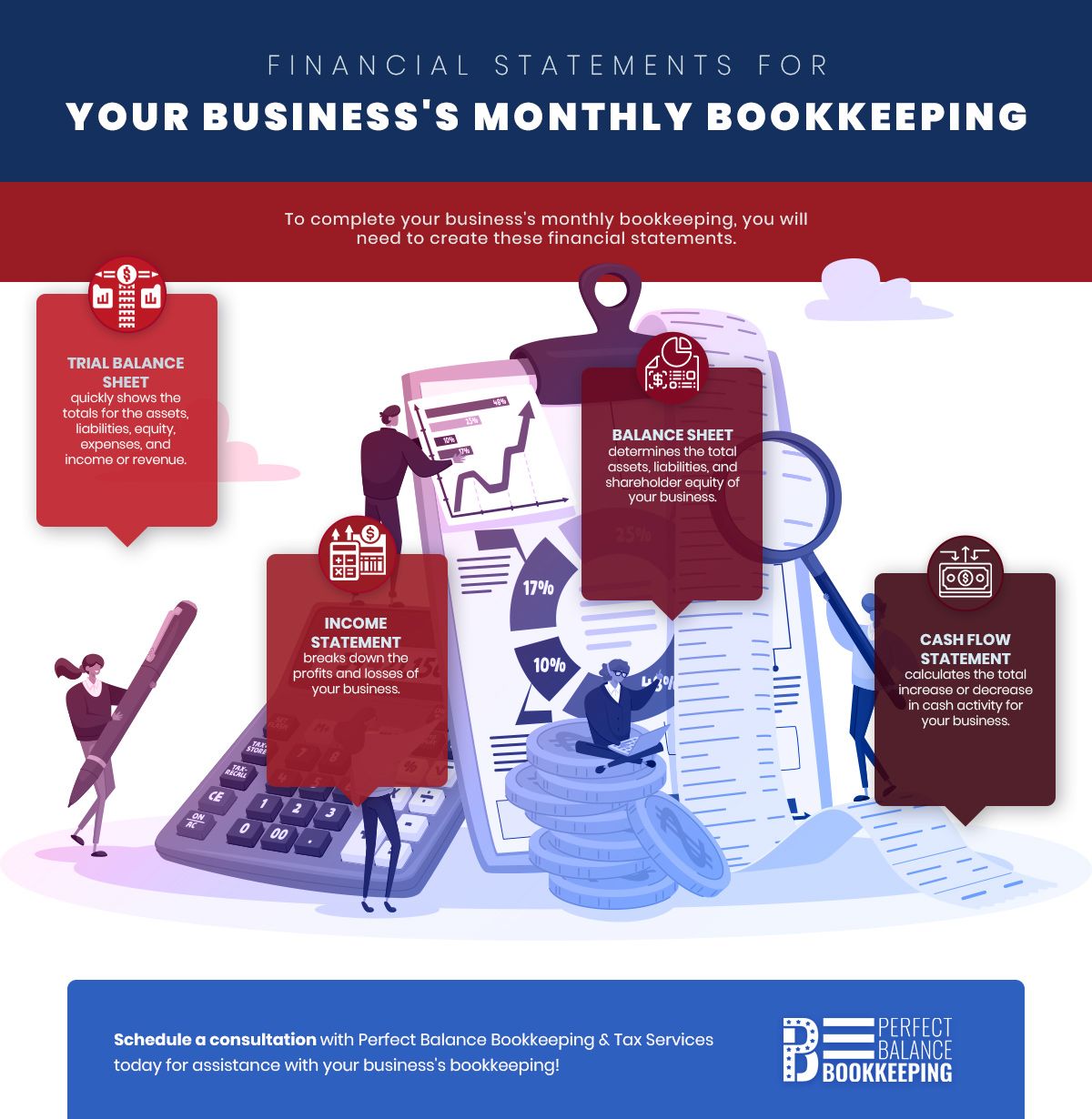

Tracking financials and providing updates monthly is a vital part of a business’s bookkeeping responsibilities to express how the business has performed within the last month. The standard monthly financial reporting includes an income statement, balance sheet, and cash flow statement. In today’s post from Perfect Balance Bookkeeping & Tax Services, we are going to look at how to prepare for monthly bookkeeping, and the statements it should include, so that you can be confident when reporting your business’s performance each month. Request a consultation with our Perfect Balance Bookkeeping & Tax Services team today for assistance with your bookkeeping!

How to Prepare Your Business’s Monthly Bookkeeping

How to Prepare Your Business’s Monthly Bookkeeping

General Ledger

We want to first start off with the general ledger to ensure all your business financials are in balance before we begin preparing any of the monthly financial statements. The general ledger should include assets, liabilities, equity, expenses, and income or revenue. All company transactions should be posted in the general ledger, so this will be an important reference when preparing the income statement, balance sheet, and cash flow statement.

Before we begin preparing the financial statements for the month, you will need to reconcile your general ledger to ensure its accuracy. To do so, list all the current debit and credit balances for your business — this creates what is known as a trial balance. Now, you will want to cross check the trial balance with the totals from the general ledger. If these balances do not match, work through the general ledger to find any errors of omission or commission. Adjust any unrecorded earnings and expenses on the trial balance. With the trial balance accurate and complete, you can confidentiality transfer its information over to your financial statements.

Income Statement

A monthly income statement is responsible for showing the profits and losses of your business over the last three months. To prepare your income statement for the month, follow these simple steps:

- Identify the specific month this income statement will be analyzing.

- Revenue — this is the amount of all the money you earned from your services or products, including those that you have not yet received payment on. This total can be found by adding up all revenue lines from your trial balance.

- Cost of Goods Sold — this will include all expenses from direct labor, materials, and overhead that were required to provide your services or products to your customers. This total can also be found by adding up the cost of goods sold from the trial balance.

- Gross Margin — this can be found by subtracting the cost of goods sold from the revenue totals for the month. The gross margin shows the gross amount earned from your products or services.

- Operating Expenses — this will include all the selling and administrative expenses to run the business found on the trial balance.

- Income — this is calculated by subtracting the total of selling and administrative expenses from the gross margin, leaving you with the pre-tax income for your business.

- Income Taxes — this is determined by multiplying the pre-tax income previously calculated by the applicable tax rate of your state.

- Net Income — this can be calculated by subtracting the income tax from the pre-tax income that were both previously determined.

- Finalize the income statement by adding a header and your business information.

Balance Sheet

The monthly balance sheet is used to show the total assets, liabilities, and shareholder equity of your business. Balance sheets both breakdown each of these into line items, as well as offer the ending total.

Assets

We will start by identifying all of your business’s assets. These are most commonly broken down as follows:

- Current Assets

- Cash and cash equivalents

- Short-term marketable securities

- Accounts receivable

- Inventory

- Other current assets

- Non-Current Assets

- Long-term marketable securities

- Property

- Goodwill

- Intangible assets

- Other non-current assets

Once identified, subtotal the current assets and the non-current assets, and then add them together for your final asset total.

Liabilities

Next, you will then breakdown your business’s liabilities similar to how we did the assets above. The line items for liabilities should be as follows:

- Current Liabilities

- Accounts payable

- Accrued expenses

- Deferred revenue

- Current portion of long-term debt

- Other current liabilities

- Non-Current Liabilities

- Deferred revenue (non-current)

- Long-term lease obligations

- Long-term debt

- Other non-current liabilities

As with the assets, you will subtotal the current liabilities and the non-current liabilities, and then add them together for your final liabilities total.

Shareholders’ Equity

For shareholders’ equity, you will want to breakdown the line items as shown below, and add them together to find your final shareholders’ equity total.

- Common stock

- Preferred stock

- Treasury stock

- Retained earnings

Lastly, it is time to balance your balance sheet. To do this, add the total liabilities and total shareholders’ equity previously calculated, and compare the total to the total amount of assets previously calculated. These numbers should match, which signifies that your balance sheet is complete and accurate.

Cash Flow Statement

Now that you have completed your monthly income statement and balance sheet, you can now create the cash flow statement for the month. While there are two different methods, direct and indirect, that can be used to calculate the cash flow statement, the majority of businesses utilize the indirect method as follows:

- Operating Activities — this consists of taking the net income from the income statement and adjusting it with changes in current assets, liabilities and other operating activities to express how much cash was received during the daily operations of your business.

- Investing Activities — this refers to taking the non-current assets from the balance sheet, and adjusting them to represent cash activities for non-current assets to express what can be expected within investments in your business.

- Financing Activities — this is determined by taking the non-current liabilities and shareholders’ equity, along with the cash dividends paid to express the effects these items have on the cash activity of your business.

After performing these three steps, you will be left with the total increase or decrease in cash activity of your business. Lastly, you will want to reconcile the cash flow statement by ensuring that the total is equal to the change in cash determined previously on the balance sheet.

Perfect Balance Bookkeeping & Tax Services

At Perfect Balance Bookkeeping & Tax Services, our team of professionals understand that preparing the monthly bookkeeping and financial statements for your business can be overwhelming and leave you frustrated and stressed. When you choose our bookkeeping services, you can have confidence that your business bookkeeping will be completed thoroughly and accurately. Request a consultation with Perfect Balance Bookkeeping & Tax Services today and get back to focusing on other important areas of your business.